Campaign

Threadneedle (Lux) Emerging Market ESG Equities Fund

At a glance

A global emerging markets (EM) equity strategy that targets companies who exhibit strong or improving Environmental, Social and Governance (ESG) qualities as well as sustain and accelerate high-quality and profitable growth.

Reasons to invest

1. Strong EM heritage:

Our experienced EM team has a proven track record of consistently generating strong alpha through bottom-up research and stock selection.

2. ESG benefit:

We systematically apply ESG factors to identify investment opportunities, screen for material risks, and optimize the portfolio. The investment process incorporates Columbia Threadneedle’s evidence based, data-driven proprietary Responsible Investment (RI) model, taking advantage of its forward-looking investment signals to support fundamental research.

Key facts

Fund inception date

23 September 2020

Benchmark index

MSCI Emerging Markets Index

1. Strong EM heritage:

Our experienced EM team has a proven track record of consistently generating strong alpha through bottom-up research and stock selection.

2. ESG benefit:

We systematically apply ESG factors to identify investment opportunities, screen for material risks, and optimize the portfolio. The investment process incorporates Columbia Threadneedle’s evidence based, data-driven proprietary Responsible Investment (RI) model, taking advantage of its forward-looking investment signals to support fundamental research.

Key facts

Fund inception date

23 September 2020

Benchmark index

MSCI Emerging Markets Index

3. Core innovators:

We believe companies with innovation at their core, creating and embracing new ideas, processes and technology, can gain a competitive advantage, win market share and drive long-term growth.

Key facts

Fund inception date

23 September 2020

Benchmark index

MSCI Emerging Markets Index

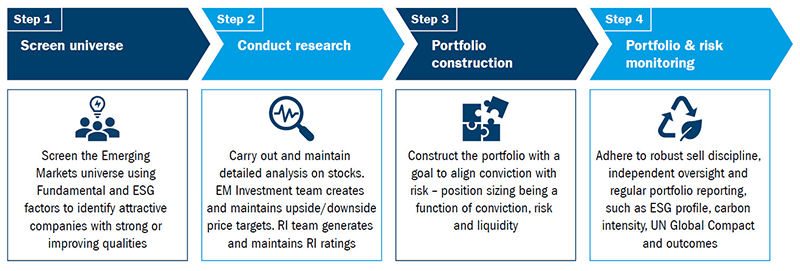

Investment Approach

The market often underestimates the ability of highly innovative businesses to sustain high returns on capital and strong growth over the long run. Many such highly innovative companies also lead their peers in ESG best practices.

We seek to identify and invest in high-quality innovators through a combination of a detailed fundamental analysis and Columbia Threadneedle’s proprietary ESG research.

We utilise a ‘stewards-of-capital’ and competitive advantage framework to identify companies that can sustain and accelerate profitable growth over the long term, with a focus on return on invested capital. We work closely with our RI team to build a high conviction, best ideas portfolio of emerging markets innovative, ESG-friendly companies.

As we take a ‘go anywhere’ approach, stock selection drives sector and country weightings, and we believe our focus on long-term sustainable practices will drive outperformance across a range of market conditions.

Fund Objective

The Fund invests at least two-thirds of its assets in shares of companies in emerging markets and/or companies that have significant operations in emerging markets. The companies that the Fund invests in are companies that meet the fund manager’s environmental, social and governance (ESG) criteria.

The Fund may invest up to 30% of its assets in China A Shares via the China-Hong Kong Stock Connect Programme. The Fund may also invest in asset classes and instruments different from those stated above.

The Fund is actively managed in reference to the MSCI Emerging Markets Index. The index is broadly representative of the companies in which the Fund invests, and provides a suitable target benchmark against which Fund performance will be measured and evaluated over time. The fund manager has discretion to select investments with weightings different to the index, and that are not in the index, and the Fund may display significant divergence from the index. Deviations from the index, including limits on the level of risk relative to the index, will be considered as part of the fund manager’s risk monitoring process, to ensure the overall level of risk is broadly consistent with the index. In line with its active management strategy, there may be significant deviation from the index. Income from investments in the Fund will be added to the value of your shares.

You can buy or sell shares in the Fund on any day which is a business day in Luxembourg unless the directors have decided that insufficient markets are open. Such days are published on columbiathreadneedle.com. You can find more detail on the investment objective and policy of the Fund in the section of the prospectus with the heading “Investment Objectives and Policies”.

For more information on investment terms used in this document, please see the Glossary published in the Document Centre on our website: www.columbiathreadneedle.com.

Fund Manager

Dara White is the global head of emerging market equities at Columbia Threadneedle Investments and has acted as lead portfolio manager of emerging market equity strategies since 2008. He joined the company in 2006 as co-manager of the strategic investor team and is based in Portland. Prior to this, Dara was a portfolio manager and analyst with RCM Global Investors. Dara received a degree in finance and marketing from Boston College. He is a member of the CFA Institute and the Security Analysts of San Francisco. In addition, he holds the Chartered Financial Analyst designation.

Key Risks

Past performance is not a guide to future returns and the fund may not achieve its investment objective. Your capital is at risk. The value of investments can fall as well as rise and investors might not get back the sum originally invested. The Fund has a concentrated portfolio (holds a limited number of investments and/or has a restricted investment universe) and if one or more of these investments declines or is otherwise affected, it may have a pronounced effect on the fund’s value. Where investments are in assets that are denominated in multiple currencies, or currencies other than your own, changes in exchange rates may affect the value of the investments. The Fund aims to invest in companies with strong or improving environmental, social and governance (ESG) characteristics, as outlined in the fund’s ESG Investment Guidelines. The Guidelines will affect the Fund’s exposure to certain sectors, which may impact the performance of the Fund positively or negatively relative to a benchmark or other funds without such restrictions. The fund invests in markets where economic and regulatory risk can be significant. These factors can affect liquidity, settlement and asset values. Any such event can have a negative effect on the value of your investment. The investment policy of the fund allows it to invest in derivatives for the purposes of reducing risk or minimising the cost of transactions. The fund holds assets which could prove difficult to sell. The fund may have to lower the selling price, sell other investments or forego more appealing investment opportunities. The fund typically carries a risk of high volatility due to its portfolio composition or the portfolio management techniques used. This means that the fund’s value is likely to fall and rise more frequently and this could be more pronounced than with other funds. The Fund may invest through the China-Hong Kong Stock Connect programmes which have significant operational constraints including quota limits and are subject to regulatory change and increased counterparty risk. All the risks currently identified as being applicable to the Fund are set out in the “Risk Factors” section of the Prospectus. Please read the Key Investor Information Document and the Fund Prospectus if considering investing.

For use by professional clients and/or equivalent investor types in your jurisdiction (not to be used with or passed on to retail clients). For marketing purposes. Past performance is not a guide to future performance. The value of investments and any income is not guaranteed and can go down as well as up and may be affected by exchange rate fluctuations. This means that an investor may not get back the amount invested.

Your capital is at Risk. This material is for information only and does not constitute an offer or solicitation of an order to buy or sell any securities or other financial instruments, or to provide investment advice or services. Threadneedle (Lux) is an investment company with variable capital (Société d’investissement à capital variable, or “SICAV”) formed under the laws of the Grand Duchy of Luxembourg. The SICAV issues, redeems and exchanges shares of different classes. The management company of the SICAV is Threadneedle Management Luxembourg S.A, which is advised by Threadneedle Asset Management Ltd. and/or selected sub-advisors. Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the ‘Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. Documents other than KIIDs are available in English, French, German, Portuguese, Italian, Spanish and Dutch (no Dutch Prospectus). KIIDs are available in local languages. The summary of investor rights is available on our website in English. Documents can be obtained free of charge on request by writing to the management company at 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg, from International Financial Data Services (Luxembourg) S.A. at 47, avenue John F. Kennedy, L-1855 Luxembourg, Grand Duchy of Luxembourg, from www.columbiathreadneedle.com. The mention of any specific shares or bonds should not be taken as a recommendation to deal. The analysis included in this document has been produced by Columbia Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed. This document is a marketing communication. The analysis included in this document have not been prepared in accordance with the legal requirements designed to promote its independence and have been produced by Columbia Threadneedle Investments for its own investment management activities, may have been acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice and should not be seen as investment advice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed.

Threadneedle Management Luxembourg S.A. Registered with the Registre de Commerce et des Sociétés (Luxembourg), Registered No. B 110242, 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies

columbiathreadneedle.com