Threadneedle (Lux) European Social Bond

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions.

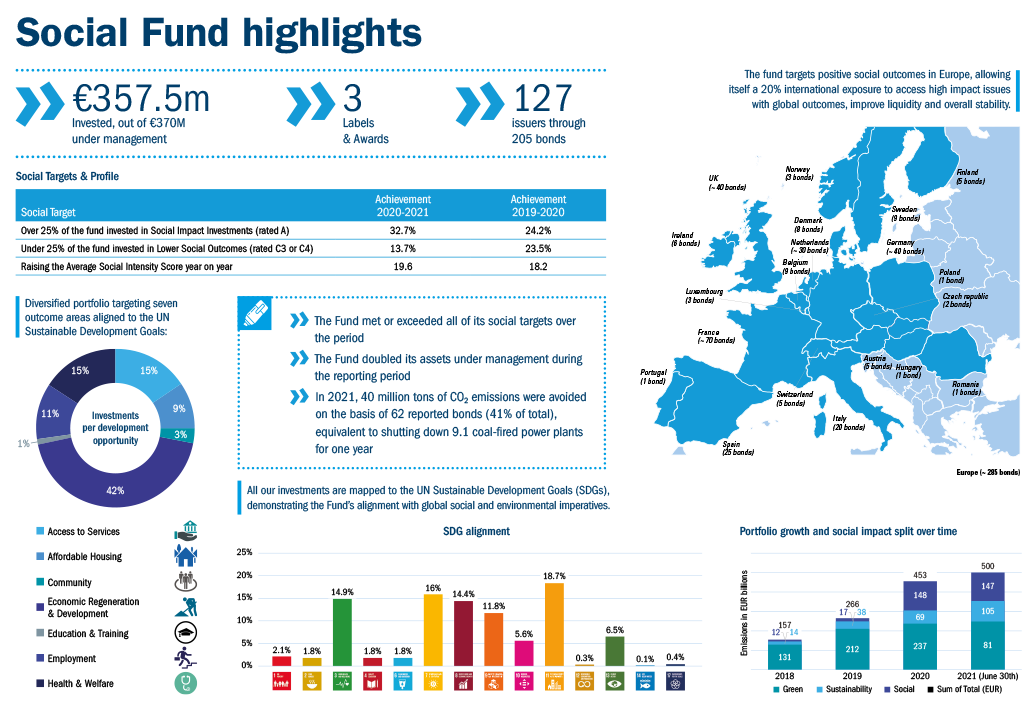

At a glance

Key facts

Article 8*

Fund Inception date:

23 May 2017

Fund Manager

Simon Bond

Benchmarks notes:

Composite index comprising: 50% ICE BofA Euro Non-Sovereign; 50% ICE BofA Euro Corporate Euroland Issuers

Source: Towards Sustainability valid + 2021

Investing in positive social outcomes

We invested in organisations and bonds delivering and enabling tangible impact.

The decision to invest in the promoted fund should also take into account all the characteristics or objectives of the promoted fund as described in its prospectus. The fund’s sustainability related disclosures can be found here.

Annual Social Impact Report

We believe in

Key reasons to invest

- Innovative approach: Using a dynamic social research methodology to guide investment decisions, the portfolio manager actively sources bonds that combine clear social benefits with sound financial attributes.

- Strength in partnership: Our strong reputation across both fixed income credit and social investment is enhanced by our social partnership with INCO Group1, an organisation focused on the European social economy and a leader in assessing sustainable social businesses.

- Proven track record in social bond investing: We have successfully managed outcomes-focused social bond strategies since 2013, and have over €1 billion invested in a range of strategies for clients in the UK, Europe and the US.

Risks to be aware of

This fund is suitable for investors who can tolerate a moderate level of risk in return for solid returns over a medium-term investment horizon. Investors should read the Prospectus for a full description of all risks.

Investment risks: Investment in debt securities, derivatives and currencies.

Associated risks: The fund may be exposed to additional credit, market, interest rate and liquidity risks due to the nature of investing in debt markets.

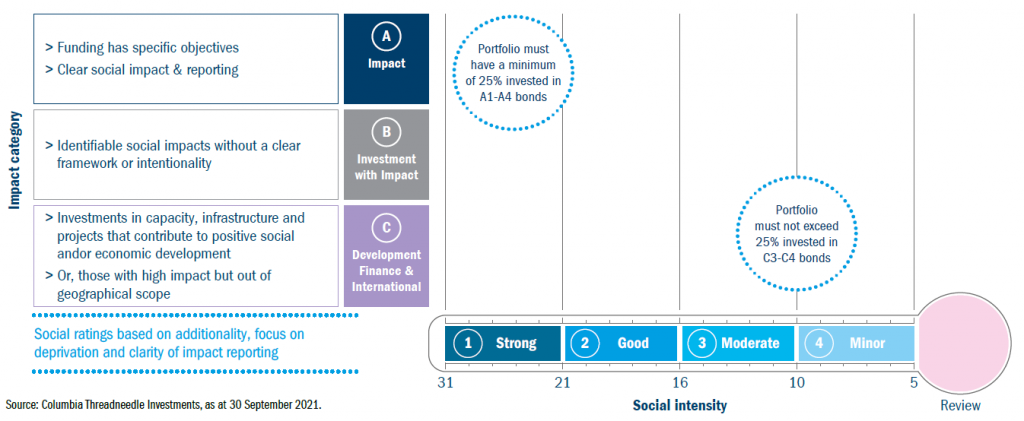

Investment approach

Outcome-focused approach aligned with SDGs

Social assessment methodology directs investments to positive social outcomes

Our social partner, INCO Group, brings its expertise and reputation by deepening the research on the social outcomes of potential investments; reviewing, advising and monitoring our social assessments via a quarterly Social Advisory Panel; and producing an independent annual report.

Insights

In search of sustainability – following Highway 101

The climate-health nexus: risks and opportunities

Green machines: the future of transport

Fund Manager

Simon Bond joined the company in 2003 and has been the portfolio manager of the Threadneedle UK Social Bond Fund since its launch in 2013, as well as the Threadneedle (Lux) European Social Bond Fund which launched in 2017. Having previously managed a number of institutional and retail investment grade corporate bond portfolios, Simon now concentrates his focus on managing Columbia Threadneedle's social bond portfolios and developing other responsible investment strategies across the firm.

Simon has 34 years' experience in the fund management industry, with the last 29 years specialising in corporate credit. Throughout his career, Simon has taken a keen interest in the social investment space and as an analyst the first entity Simon reported on was Peabody Trust and the first sector he covered was housing associations. Simon is particularly passionate about the role of infrastructure in both regeneration and economic growth.

Prior to joining the firm, Simon managed £6 billion in his role as the Senior UK Credit Fund Manager for AXA. Simon also worked for GE Insurance as a Portfolio Manager, Provident Mutual as a Fixed Income Analyst and Hambros Bank as an Investment Accountant and Pension Fund Investment Administrator.

Simon is a Fellow of the Chartered Institute for Securities and Investment, holds the Investment Management Certificate and the General Registered Representatives Certificate.

The LuxFLAG ESG Label is valid for the period ending on 30 September 2022. Investors must not rely on LuxFLAG or the LuxFLAG Label with regard to investor protection issues and LuxFLAG cannot incur any liability related to financial performance or default.

Important Information

Important information: Your capital is at risk. Threadneedle (Lux) is a Luxembourg domiciled investment company with variable capital (“SICAV”), managed by Threadneedle Management Luxembourg S.A.. This material should not be considered as an offer, solicitation, advice or an investment recommendation. This communication is valid at the date of publication and may be subject to change without notice. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness. The SICAV´s current Prospectus, the Key Investor Information Document (KIID) and the summary of investor rights are available in English and/ or in local languages (where applicable) from the Management Company Threadneedle Management Luxembourg S.A., International Financial Data Services (Luxembourg) S.A., your financial advisor and/or on our website www.columbiathreadneedle.com. These documents are available in Switzerland from the Swiss Representative and Paying Agent RBC Investor Services Bank S.A., Esch-sur-Alzette, Zurich branch, Bleicherweg 7, CH 8027 Zurich. Threadneedle Management Luxembourg S.A. may decide to terminate the arrangements made for the marketing of the SICAV. Pursuant to article 1:107 of the Act of Financial Supervision, the sub-fund is included in the register that is kept by the AFM. Threadneedle (Lux) is authorised in Spain by the Comisión Nacional del Mercado de Valores (CNMV) and registered with the relevant CNMV’s Register with number 177. Past performance is calculated according to the BVI method in Germany.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.