Threadneedle (Lux) Global Technology Fund

Reasons to invest

Resourced for success

Paul Wick is the longest tenured portfolio manager in the US technology sector and is supported by one of the largest and most experienced global technology teams in the industry. The 12-strong team is able to leverage the wider resources of the Columbia Threadneedle Investments’ group, drawing on a range of expert knowledge and macro, top-down insights.

High-conviction global approach

While most of the prominent tech companies are American, there are a number of powerhouses outside the US. This actively managed fund offers investors access to a concentrated ‘best ideas’ portfolio of technology and technology-related companies from around the globe. Our approach is not benchmark-oriented: we will hold companies where the team has a high degree of conviction and insight.

Contrarian in nature

We follow a disciplined investment process using fundamental analysis to identify companies that have the best growth prospects, are trading at attractive valuations and have the potential to deliver solid investment returns over time. Contrarian in nature, we seek to take advantage of misunderstood and under-researched companies to benefit from trends before they are fully appreciated by the market.

Driven by high-quality research

Meeting companies and conducting our own fundamental research drives our decision-making and lies at the heart of our stock-picking approach. As the only major tech team based in California’s Silicon Valley, we are at the heart of the technology industry, with direct access to major companies and innovative start-ups. compañías importantes e innovadoras start-ups.

Key facts

- Strategy inception date:

30 April 1997 - Benchmark index:

MSCI World – Information Technology - Peer group:

GIFS Offshore – Sector Equity Technology

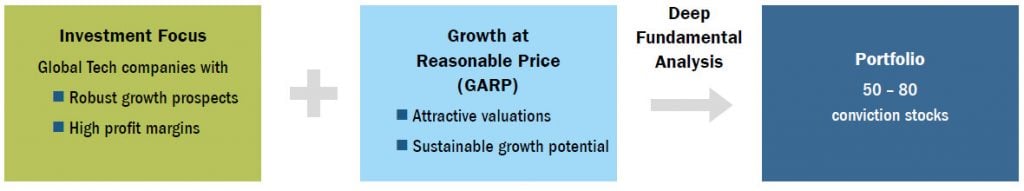

Investment approach

The Global Technology team assesses a company’s future growth and capital appreciation potential against its current valuation when constructing a concentrated and conviction-weighted portfolio. This investment approach of balancing growth with valuation awareness has allowed the strategy to meaningfully participate in rising markets, while protecting capital in higher risk environments.

The large and experienced team is led by the longest tenured fund manager in the technology sector and has offices strategically located in Menlo Park, California (Silicon Valley) and New York City. Fundamental investment analysis focuses on free cash flow generation, competitive advantages, current or nearterm path to profitability and valuations that allows for future appreciation. Detailed analysis combined with industry knowledge seeks to exploit significant technological trends that are not yet appreciated by the marketplace; the team’s investment theses are often considered contrarian in nature.

The portfolio manager will sell companies that exhibit slowing revenue or earnings growth, whose business franchises are threatened by an industry shift or technological innovation, that exhibit a deterioration in their financial position or that approach established valuation targets.

Identifying the best growth opportunities

Share classes available

Share | Class | Curr | Tax | AMC | Entry charge | Min Inv. | Launch | ISIN | SEDOL | BBID | WKN/Valor/ CUSIP | Hedged |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

AU | Acc | USD | Gross | 1,65% | 5,00% | 2.5 | 12/03/2010 | LU0444971666 | BD34WQ9 | TNGTEAU LX | A1CU1W | No |

AEH | Acc | EUR | Gross | 1,65% | 5,00% | 2.5 | 13/05/2013 | LU0444972557 | – | TNGTEAH LX | A1CU1Z | Yes |

DU | Acc | USD | Gross | 2,00% | 1,00% | 2.500 | 12/03/2010 | LU0444973449 | B5BJ8R3 | TNGTEDU LX | A1CS3G | No |

BU | Acc | USD | Gross | 2,00% | 0,00% | – | 12/03/2010 | LU0476273544 | B4SF7Z8 | TNGTEBU LX | A1CU1X | No |

DU | Acc | EUR | Gross | 2,00% | 1,00% | 2.500 | 12/03/2010 | LU0757431738 | B8F4TF0 | TNGTDUE LX | A1JVL6 | No |

ZU | Acc | USD | Gross | 0,85% | 5,00% | 2.000.000 | 22/09/2014 | LU0957808578 | BQ3BG36 | TNGTZUU LX | A12ACH | No |

Fund Manager

Paul Wick is the lead portfolio manager for the Seligman Technology Group at Columbia Threadneedle Investments. He joined the company in 1987 and for almost two decades has managed the Seligman Communications and Information Strategy. In 2001, he began managing a long-short investment vehicle focused on opportunities in the technology sector. He is recognised as a leading technology investor, specialising in the semiconductor and electronic capital equipment industries, as well as in the software and computer hardware industries.

Important Information

Het compartiment is op grond van artikel 1:107 van de Wet op het financieel toezicht opgenomen in het register dat wordt gehouden door de Autoriteit Financiële Markten. / Pursuant to article 1:107 of the Act of Financial Supervision, the subfund is included in the register that is kept by the AFM.

Subscriptions to a Fund may only be made on the basis of the current Prospectus and the Key Investor Information Document, as well as the latest annual or interim reports and the applicable terms & conditions. Please refer to the ‘Risk Factors’ section of the Prospectus for all risks applicable to investing in any fund and specifically this Fund. The above documents are available in English, French, German, Portuguese, Italian, Spanish and Dutch (no Dutch Prospectus) and can be obtained free of charge on request by writing to the management company at 44, rue de la Vallée, L-2661 Luxembourg, Grand Duchy of Luxembourg and/or from

- in Austria from Erste Bank, Graben 21 A-1010 Vienna;

- in Belgium: CACEIS Belgium S.A., avenue du Port 86 C b 320, 1000 Brussel;

- in France from CACEIS Bank, 1/3 Place Valhubert, 75013 Paris;

- in Germany from JP Morgan AG, Junghofstr. 14, 60311 Frankfurt;

- in Sweden from Skandinaviska Enskilda Banken AB (publ), Kungsträdgårdsgatan, SE-10640, Stockholm;

- in the UK from JPMorgan Worldwide Securities Services, 60 Victoria Embankment, London EC4Y 0JP.

You may also like

About Us

Millions of people around the world rely on Columbia Threadneedle Investments to manage their money. We look after investments for individual investors, financial advisers and wealth managers, as well as insurance firms, pension funds and other institutions.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.

Investment Approach

Teamwork defines us and is fundamental to our investment process, which is structured to facilitate the generation, assessment and implementation of good, strong investment ideas for our portfolios.