Infrastructure

Realising opportunities in infrastructure

Infrastructure assets can provide steady returns over the longer term and have a low correlation to other asset classes. In times of economic trubulence they can be resilient, making them increasingly appealing to investors.

This highly innovative strategy aims to deliver sustainable, inflation-linked income and capital growth from a diversified portfolio of investments in European mid-market infrastructure assets and support the transition to net zero.

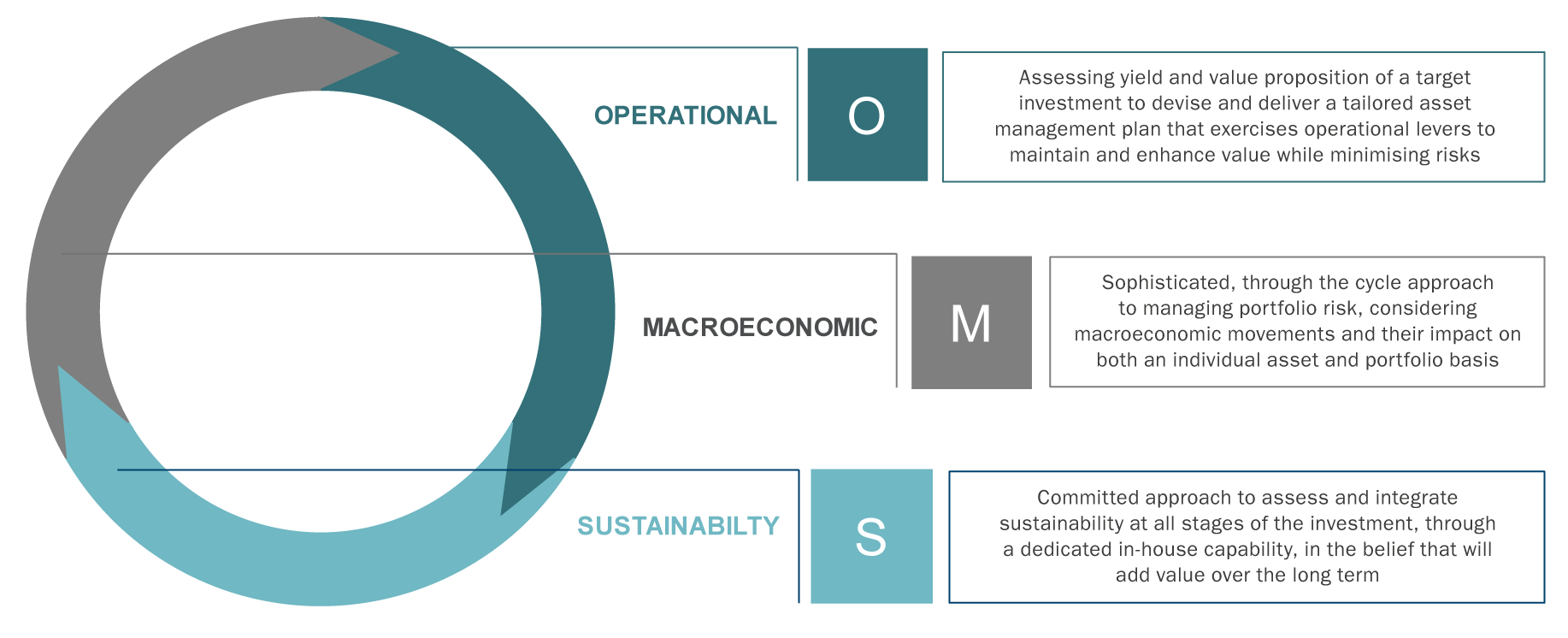

The investment approach has been to target assets with core infrastructure fundamentals such as long asset life, natural monopolies, high barriers to entry, provision of essential services and stable cash flows.

Using the UN Sustainable Development Goals as a guide, we focus on sustainable trends and sectors to identify high-quality infrastructure investments with current yield potential and the opportunity to drive value though active asset management by unlocking latent capital growth potential through expansion, operational or technological upgrades.

We believe the European mid-market is particularly attractive for private infrastructure investment, on the backdrop of a significant estimated funding gap. This translates into less competitive pressures and more opportunity for initiating bilateral, negotiated situations that our investment team can unlock. This is likely to continue over the long term, underpinned by a supportive investment and regulatory environment that encourages long-term private investment in essential assets and services and incentivises the transition to a carbon neutral economy.

Green hydrogen is finally showing its true colours

Funding Europe’s green infrastructure finance gap

European sustainable infrastructure - in a sweet spot

Sustainable Infrastructure - A sustainable perspective on digital infrastructure

Euro pipeline proposal brings hydrogen to the demand side

Summer slumber soothes markets

You may also like

About us

Millions of people around the world rely on Columbia Threadneedle Investments to manage their money. We look after investments for individual investors, financial advisers and wealth managers, as well as insurance firms, pension funds and other institutions.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.

Investment Options

We offer a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes.