6.45pm, 15 March 2021 – this is my appointment for a first dose of the Covid vaccine. I don’t want to give away my age, but by then approaching 25 million people will have received their first vaccine dose in the UK – close to half the adult population. I don’t know which vaccine I will get, but either way we are on our way. The grand reopening is coming.

One element of our research intensity that has come into its own during the pandemic has been our data science team. In a rapidly changing world, their work alongside that of our healthcare team has been critical in understanding and finding evidence on the economy and underlying trends. Real time data and our contracts with our companies were the only real way of monitoring our investments.

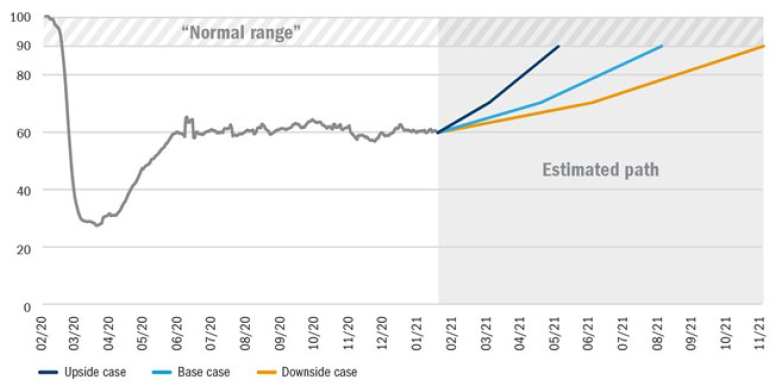

The data science team has a “Return to Normal” index monitoring everything from restaurant reservation data to TSA (Transportation Security Administration) throughput, event ticketing to coffee shop spending, foot traffic to hair and beauty spend. Gone will be the lockdown haircuts when we return to “normal”.

Figure 1: The Return to Normal Index over time – level as of 1 March: 60%

Source: Columbia Threadneedle Investments, 1 March 2021.

Making up for lost time

Like all grand reopenings there will be a tendency for everyone to overdo things. That first pint or glass of wine in your favourite bar or pub is unlikely to be a solitary one. This need to make up for lost time is supported by the record levels of savings in the system. The US savings rate is at 20.5%; though down from a peak of 33.7% in April 2020, this is still well above any levels seen in the post-WWII era . I am not sure we even need President Biden’s recently passed $1.9 trillion stimulus bill. As all good detectives know, you need means, motive and opportunity. We have the first two, and we’re poised to get the third: opportunity is about to hit capacity that is still constrained or recovering from the pandemic. Inventories will need to be rebuilt and staff rehired, while there may still be residual checks on capacity from remaining Covid precautions.

Will the spending boost translate to rising inflation?

Clearly, we have the recipe for the buzzword of the day – inflation. Businesses won’t need to discount to attract custom. As you refresh your wardrobe for whichever way your waistline has trended during lockdown you are likely to be less price sensitive. If you take the kids to Disneyland, assuming you can get a booking, and they want that particular toy or ice cream – what the hell? That extra spend, on cost bases that have been streamlined during the pandemic, will be great for company profit margins.

For this to translate into an inflation issue rather than a transitory blip there needs to be more and typically it needs to go into the wage setting process. When your store card is maxed out or your kids have spent your last at Disneyland, good luck asking your boss for that pay rise! So we don’t see a sustained period of pricing power, and inflation in the medium term remain subdued.

Of course, the opportunity in the grand reopening has not gone unnoticed by the world’s stock markets. Most are at their highs, with the MSCI ACWI some 15% above its pre-pandemic levels. While early in the pandemic it was driven by those businesses that benefited from our constrained spending patterns during the lockdown, of late – and particularly since the approval of the first vaccine on 9 November – it has been supplemented by those businesses that will benefit from the grand reopening.

Walt Disney is held across global equity portfolios, and with parks representing a significant proportion of the business, it will benefit. But for the valuation of the business what is more important? The bumper year it will experience as the parks reopen or the fact that consumers will retain the Disney+ subscription they took out to entertain the kids during lockdown? I believe it’s the latter, that secular trend towards over-the-top media consumption. Disney, through the power of its content and significant investment, has secured its position in the new streaming world.

The dominance of secular trends

In microcosm Disney represents the current battle for leadership in the market. In the coming year, finding companies that can grow earnings will not be challenging, so why not buy the one on the low valuation multiple? This is a trend reinforced by bond yields rising from their pandemic lows, impinging on the valuation levels of all stocks, particularly those with durable growth.

However, while reopening the parks is the driver of Disney’s earnings recovery this year, what really matters for the valuation of the business is the success of Disney+. Were you one of the 100 million people to take on a subscription since launch? The secular dominates the cyclical on any medium-term view and investment thinking should reflect that priority.

Over-the-top media (ie, content streamed over the internet directly to consumers), digitisation, cloud computing, AI, next-generation sequencing, ecommerce penetration, online advertising, digital payments, the emergence of the emerging market consumer, decarbonisation … the past decade has been dominated by powerful secular trends. While Covid may have accelerated their progress in 2020, we believe these will be durable in the coming decade and should still feature highly in your investment thinking. By focusing on companies with clear competitive advantage we can identify those that will thrive in the medium term.

Enjoy the grand reopening, don’t party too hard and keep a clear head to concentrate your investments on where we are going, not tomorrow, but in 2031.